Entry Paths and Methods for Foreign Enterprises' Pet Pharmaceuticals Entering China

Entry Paths and Methods for Foreign Enterprises' Pet Pharmaceuticals Entering China

Entry Paths and Methods for Foreign Enterprises' Pet Pharmaceuticals Entering China

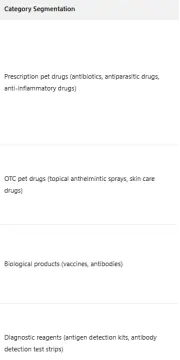

China's pet medical market is in a stage of rapid development. As a core segment, the pet pharmaceutical market reached a scale of 21.8 billion yuan in 2024, with a year-on-year increase of 19.7%. Among them, the imported pet pharmaceutical market accounted for 6.8 billion yuan, representing 31.2% of the total. Core imported categories include prescription pet drugs (antibiotics, antiparasitic drugs, anti-inflammatory drugs), over-the-counter (OTC) pet drugs (topical anthelmintic sprays, skin care drugs), biological products (vaccines, antibodies), and diagnostic reagents, with major import sources including the United States, France, Germany, Japan, etc.

For foreign enterprises entering China's pet pharmaceutical market, they must strictly comply with regulatory requirements such as the "Regulations on the Administration of Veterinary Drugs of the People's Republic of China", "Measures for the Administration of Imported Veterinary Drugs", "Measures for the Registration of Veterinary Drugs", and "National Food Safety Standard - Maximum Residue Limits of Veterinary Drugs for Pets". They need to overcome compliance barriers specific to each category, including registration and approval, production inspection, cold chain transportation, and channel control. This report systematically breaks down the differentiated requirements and key details for different categories of pet pharmaceuticals entering China, clarifies core entry paths and practical operation norms, sorts out official policy inquiry channels, elaborates on public and private domain market operation strategies, and highlights the core value of cooperating with ChinaEntryHub.com China Market Access Service Center in addressing compliance pain points and improving market entry efficiency.

I. Core Characteristics of Different Pet Pharmaceutical Categories and Differentiated Entry Requirements for China

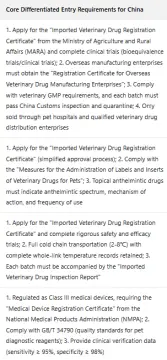

Due to differences in pharmacological properties, usage scenarios, and safety risk levels, pet pharmaceuticals have significant variations in registration and approval, inspection standards, transportation and warehousing, labeling specifications, and sales channels when entering China. Accurately grasping the differentiated requirements of each category is the core prerequisite for foreign enterprises to avoid compliance risks.

II. Core Entry Paths for Foreign Enterprises' Pet Pharmaceuticals Entering China and Differentiated Practical Norms

The core paths for foreign enterprises to enter China's pet pharmaceutical market include general trade import (mainstream bulk path), cross-border e-commerce direct supply (rapid access path for niche/unregistered drugs), and joint venture/wholly-owned production base construction (localization in-depth path). Different paths vary in category adaptability, compliance thresholds, and market coverage, requiring precise selection based on enterprise strength and product characteristics.

(I) General Trade Import: Mainstream Path for Mature Drugs, Adaptable to All Compliant Categories

General trade import is the mainstream method for foreign enterprises' pet pharmaceuticals to enter China, especially suitable for mature products with completed import registration and stable market demand (e.g., commonly used antibiotics, topical anthelmintic drugs, regular vaccines). Its advantages lie in strong compliance of circulation channels, high consumer trust, and access to core channels such as pet hospitals and regular veterinary drug chain stores; disadvantages include long registration and approval cycles, cumbersome compliance processes, and extremely high requirements for product quality control.

1. General Practical Process

- Pre-registration and approval: Complete corresponding registration by category (apply for the "Imported Veterinary Drug Registration Certificate" for veterinary drugs, and the "Medical Device Registration Certificate" for diagnostic reagents); overseas manufacturing enterprises complete registration and filing with MARA/NMPA.

- Document and label preparation: Prepare documents such as certificate of origin, health certificate, pharmacotoxicology/clinical trial reports, and application form for imported veterinary drug inspection; labels must comply with Chinese specifications (marked in Chinese, including "veterinary drug" logo, registration certificate number, manufacturing enterprise information, contraindications, and adverse reactions).

- Transportation and warehousing: Formulate transportation plans based on product characteristics (full cold chain at 2-8℃ for biological products, humidity ≤ 60% for diagnostic reagents); warehousing must comply with GSP requirements (cool and ventilated, temperature and humidity controllable).

- Customs clearance and inspection: Customs conducts document review, label verification, on-site inspection, and sampling testing; additional type tests are required for biological products and diagnostic reagents; after passing the inspection, the "Inspection and Quarantine Certificate for Imported Goods" is issued, and the products can be put on the market for circulation.

2. Category-Specific Practical Details and Case Data

- Prescription pet drugs: The application cycle for the "Imported Veterinary Drug Registration Certificate" is 8-12 months, and additional drug resistance risk assessment is required for antibiotics. Case: Merial (France)'s oral anthelmintic drug "Hailiaomiao" entered China through general trade, completing imported veterinary drug registration and clinical trials in advance. Its sales volume in China reached 920 million yuan in 2024, accounting for 18.5% of the imported pet anthelmintic drug market. Data: In 2024, 92% of imported pet pharmaceuticals entered China through general trade, including 88% of prescription drugs and 95% of biological products, with an average customs clearance cycle of 15-20 working days and a compliance pass rate of 91%.

- Biological products: Cold chain transportation requires real-time temperature monitoring equipment, and temperature fluctuations must be controlled within ±1℃. Case: Pfizer (USA)'s canine parvovirus vaccine entered China through general trade, transported by a professional cold chain logistics enterprise (SINOTRANS Cold Chain) with complete whole-link temperature records. Its sales volume in China reached 780 million yuan in 2024, accounting for 22.3% of the imported pet vaccine market.

- Diagnostic reagents: Medical device registration must be completed in advance, with a cycle of approximately 10-14 months. Case: Fujifilm (Japan)'s canine distemper antigen detection kit entered China through general trade, obtaining the "Medical Device Registration Certificate". Its sales volume in China reached 210 million yuan in 2024, accounting for 15.7% of the imported pet diagnostic reagent market.

3. Cooperative Empowerment Value

ChinaEntryHub.com can provide full-cycle compliance support tailored to each category: For prescription pet drugs, assist in sorting out application materials for the "Imported Veterinary Drug Registration Certificate", connect with clinical trial institutions recognized by MARA, and shorten the application cycle by more than 35%; for biological products, design whole-link cold chain plans, connect with logistics enterprises qualified for veterinary cold chain, and establish a temperature traceability system; for diagnostic reagents, guide the application process for the "Medical Device Registration Certificate" and assist in completing clinical verification; conduct compliance reviews of labels, focusing on verifying key information such as registration certificate numbers, warnings, and contraindications; sort out customs clearance document lists to accelerate customs clearance efficiency, shortening the average customs clearance cycle by 40%.

(II) Cross-Border E-Commerce Direct Supply: Rapid Access Path for Niche/Unregistered Drugs, Adaptable to Products with Specific Needs

This path is suitable for niche pet drugs that have not yet completed domestic registration (e.g., drugs for rare diseases) and new diagnostic reagents, relying on bonded warehouse/direct mail models to quickly reach high-end pet hospitals and pet owners with specific needs. Its advantages include no need for prior domestic registration and approval, fast market launch, and rapid market demand testing; disadvantages include restrictions by cross-border regulatory policies (e.g., limited to personal use, single purchase limit of 5,000 yuan), inability to conduct large-scale distribution, and extremely high cold chain costs for special categories such as biological products.

1. Category-Specific Practical Norms

- Non-cold chain drugs (topical anthelmintic sprays, skin care drugs): Adopt the "bonded warehouse pre-storage" model; labels must use "electronic labels + paper Chinese inserts" with complete core information (dosage and administration, contraindications, shelf life).

- Cold chain drugs (biological products, diagnostic reagents): Adopt the "direct mail + full cold chain" model; select logistics enterprises qualified for cross-border cold chain; temperature records must cover the entire link from overseas warehouses to domestic consumers, and a temperature record sheet must be enclosed in the package.

- Diagnostic reagents: Must be marked with "cross-border e-commerce exclusive" and "for personal use only", and bulk sales are prohibited; product technical specifications and summaries of clinical performance verification must be provided.

2. Cases and Data

Case 1: A niche pet arthritis treatment drug from Germany entered China through JD Global Direct Mail, targeting high-end pet hospitals and pet owners with specific illnesses. Its cross-border e-commerce sales volume reached 32 million yuan in 2024, a year-on-year increase of 82%. Case 2: A new pet allergy detection kit from the United States entered China through Tmall Global's bonded warehouse model, stored in Shanghai Bonded Warehouse, and achieved delivery within 72 hours in core cities relying on professional cold chain. Its cross-border sales volume reached 18 million yuan in 2024. Data: In 2024, the scale of China's cross-border e-commerce imports of pet pharmaceuticals reached 420 million yuan, a year-on-year increase of 68%, including 45% of diagnostic reagents, 35% of niche prescription drugs, and 20% of biological products; the repurchase rate of high-end products in cross-border channels reached 42%, with main customers being high-end pet hospitals and high-net-worth pet owners.

3. Cooperative Empowerment Value

ChinaEntryHub.com can provide full-link cross-border e-commerce services: Assist in connecting with cross-border platforms such as Tmall Global and JD Global, and complete platform entry qualification review (e.g., verification of overseas manufacturing enterprise qualifications); optimize the design of electronic labels and Chinese inserts to ensure compliance of core information; guide the preparation of documents for bonded warehouse entry and interpret cross-border tax policies (details of tariff and value-added tax reductions and exemptions); connect with professional cross-border cold chain logistics enterprises, establish a whole-link temperature traceability system from "overseas warehouse - bonded warehouse - consumer", and avoid product failure risks caused by cold chain disruption; assist in responding to platform compliance spot checks and avoid delisting risks due to non-compliant labels and unclear usage annotations.

(III) Joint Venture/Wholly-Owned Production Base Construction: Localization In-Depth Path, Adaptable to Long-Term Market Layout

This path is suitable for foreign enterprises with strong financial strength and plans to deepen their presence in China's market for a long time, especially for products requiring localization adaptation (e.g., vaccines adapted to common pet diseases in China, prescription drugs suitable for the physical condition of Chinese pets). Its advantages include reducing import tariffs and transportation costs, quickly responding to market demand, and deeply binding domestic pet medical channels; disadvantages include large initial investment, long preparation cycle, and high requirements for integrating local policies and supply chain resources.

1. Category-Specific Practical Key Points

- Prescription pet drugs/biological products: Production bases must comply with veterinary GMP requirements, equipped with professional sterile production workshops, cold chain warehousing, and quality inspection laboratories; reapply for the domestic "Veterinary Drug Production License", and product formulas can be adjusted according to the epidemic trend of pet diseases in China.

- Diagnostic reagents: Production bases must comply with the Good Manufacturing Practice for Medical Devices (GMP), equipped with reagent R&D and clinical verification workshops; can connect with local biological raw material suppliers to reduce production costs.

2. Case Analysis

Case 1: Zoetis (USA) established a joint venture pet pharmaceutical production base in Jiangsu with a local Chinese enterprise, producing canine distemper and parvovirus combined vaccines adapted to Chinese pets, equipped with veterinary GMP-compliant cold chain production lines and quality inspection laboratories. The sales volume of localized products reached 1.2 billion yuan in 2024, accounting for 75% of its total sales in China. Case 2: Virbac (France) established a wholly-owned production base in Zhejiang, producing pet skin care drugs and topical anthelmintic drugs, connecting with local pharmaceutical packaging suppliers to optimize product packaging for the Chinese market. The sales volume of localized products reached 480 million yuan in 2024, a year-on-year increase of 35%.

3. Cooperative Empowerment Value

ChinaEntryHub.com can provide full-cycle consulting for base construction: Assist in site selection of production bases, clarify industrial policies and tax incentives in various regions (e.g., pharmaceutical industrial parks in Jiangsu and Zhejiang); guide enterprises in completing environmental impact assessment, veterinary GMP certification, and approval of the "Veterinary Drug Production License"/"Medical Device Production License"; connect with local raw material suppliers and testing institutions to reduce localized production costs; assist in establishing a quality traceability system compliant with Chinese regulatory requirements, ensuring full-link compliance of products from raw materials to finished products, and shortening the project preparation cycle by 10-14 months.

III. Core Policy Inquiry Channels for Foreign Enterprises (Official Websites of Relevant Chinese Authorities)

In the process of entering China, foreign enterprises need to inquire about policies and standards through official Chinese channels to ensure compliant operations. The following are core inquiry channels and category-adapted functions:

1. Relevant Inquiry Platforms of the Ministry of Agriculture and Rural Affairs (MARA)

- Official Website of the Department of Animal Husbandry and Veterinary Medicine, MARA: http://www.moa.gov.cn/gk/xmsy/, inquire about application requirements, processes, and approval progress of the "Imported Veterinary Drug Registration Certificate"; download regulatory documents such as the "Regulations on the Administration of Veterinary Drugs", "Measures for the Administration of Imported Veterinary Drugs", and "Veterinary GMP Specifications".

- China Veterinary Drug Information Network: http://www.ivdc.org.cn/, inquire about the list of registered imported veterinary drugs, the list of registered overseas veterinary drug manufacturing enterprises, and the national standard for maximum residue limits of veterinary drugs for pets (GB 31650).

2. Relevant Inquiry Platforms of the National Medical Products Administration (NMPA)

- Official Website of NMPA: https://www.nmpa.gov.cn/, inquire about medical device registration requirements, the "Measures for the Registration of Medical Devices", and medical device GMP specifications related to pet diagnostic reagents.

- Official Website of the Center for Medical Device Evaluation (CMDE): https://www.cmde.org.cn/, inquire about clinical verification requirements, technical review standards, and approval progress of pet diagnostic reagents.

3. Relevant Inquiry Platforms of the General Administration of Customs (GAC)

- Inquiry of Registration Information of Overseas Manufacturing Enterprises for Imported Food: https://ciferquery.singlewindow.cn/, inquire about the registration status of overseas manufacturing enterprises of pet pharmaceuticals and confirm export qualifications.

- Official Website of the Department of Import and Export Food Safety, GAC: http://www.customs.gov.cn/customs/302249/302266/302267/index.html, inquire about inspection and quarantine policies, label review rules, and notification information of substandard products for imported pet pharmaceuticals.

4. Relevant Inquiry Channels of the Ministry of Commerce (MOFCOM)

- Official Website of the Chinese Academy of International Trade and Economic Cooperation (CAITEC), MOFCOM: http://www.caitec.org.cn/, inquire about cross-border e-commerce policies, import tariff policies, and market consumption trend data of pet pharmaceuticals.

- Official Website of the Department of Market Operation and Consumption Promotion,MOFCOM: http://www.mofcom.gov.cn/mofcom/column/ywlm/scyx/, inquire about circulation data and industry development reports of the pet medical market.

5. Cooperative Empowerment Value

ChinaEntryHub.com can provide full-cycle empowerment for official inquiries: Sort out category-specific inquiry functions of official websites of various departments (e.g., inquiry about import registration of prescription pet drugs, inquiry about medical device registration of diagnostic reagents); interpret professional clauses of policy documents (e.g., application conditions for the "Imported Veterinary Drug Registration Certificate", restrictions on personal use of cross-border e-commerce); regularly update policy dynamics (e.g., revision of maximum residue limits of veterinary drugs, adjustment of registration and approval processes) and provide targeted response suggestions; assist enterprises in completing policy verification to avoid compliance risks caused by information asymmetry (e.g., misjudgment of product category attribution leading to incorrect registration paths).

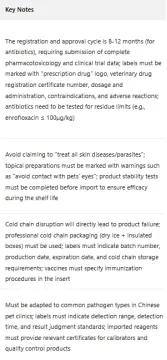

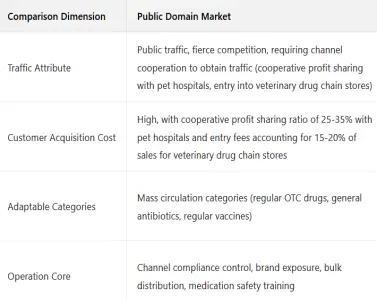

IV. Public and Private Domain Market Operation Strategies for China's Pet Pharmaceuticals (Scale, Differences, and Operation Methods)

The channels of China's pet pharmaceutical market present a pattern of "public domain dominance and private domain supplement". Due to differences in consumption scenarios and compliance requirements, different categories of pet pharmaceuticals have significant variations in adaptability to public and private domain markets. Precise channel layout is the key for foreign enterprises to improve market penetration. In 2024, the scale of China's public domain pet pharmaceutical market was 18.2 billion yuan (accounting for 83.5%), and the private domain market was 3.6 billion yuan (accounting for 16.5%), with a year-on-year increase of 52.3%. The private domain has become the core growth engine for high-end/niche drugs.

1. Market Scale and Core Differences

(1) Scale Data

In 2024, in the public domain market, pet hospital channels accounted for 65% of sales, regular veterinary drug chain stores (e.g., Ruipeng Veterinary Department, Chong'ai International Pharmacy) accounted for 25%, and compliant e-commerce platforms (limited to OTC drugs) accounted for 10%; in the private domain market, pet doctor communities/WeChat Work accounted for 55%, high-end pet health management communities accounted for 30%, and cross-border e-commerce private domain stores accounted for 15%. Among them, the private domain sales ratio of diagnostic reagents and niche prescription drugs reached 32% and 28% respectively, significantly higher than the industry average; the public domain sales ratio of regular OTC drugs and general antibiotics reached 95% and 98% respectively, belonging to typical mass circulation categories.

(2) Core Differences

2. Category-Specific Operation Methods (Including Cases)

(1) Public Domain Market Operation

- Regular OTC drugs and general antibiotics: Cooperate with national pet hospital chain institutions (Ruipeng, New Ruipeng) and veterinary drug chain stores, and dispatch professional medical representatives to conduct medication training; open official stores on compliant e-commerce platforms (e.g., Boqi.com Veterinary Drug Zone) to sell OTC drugs and provide online medication consultation. Case: Virbac (France)'s pet skin care drugs achieved a public domain sales volume of 650 million yuan in 2024 through the dual-channel layout of "pet hospitals + compliant e-commerce".

- Regular vaccines and commonly used prescription drugs: Cooperate with local animal husbandry and veterinary stations to carry out pet immunization popularization activities; participate in large-scale pet product exhibitions (e.g., Asia Pet Fair) for brand exposure and channel investment promotion. Case: Zoetis (USA)'s canine vaccines achieved a public domain sales volume of 1.5 billion yuan in 2024 through pet hospital cooperation and exhibition investment promotion.

(2) Private Domain Market Operation

- Diagnostic reagents and niche prescription drugs: Output professional content (e.g., "popularization of early diagnosis of pet tumors", "guidance on medication for rare diseases") through Douyin and Xiaohongshu to guide pet doctors and pet owners to add WeChat Work; establish pet doctor academic communities to provide product clinical application training and case exchanges; provide personalized medication plans and follow-up services for high-end pet owners. Case: Fujifilm (Japan)'s pet tumor detection kits attracted traffic through private domain academic communities, achieving a private domain sales volume of 50 million yuan in 2024 with a repurchase rate of 58%.

- High-end biological products: Cooperate with high-end pet clubs and pet health management institutions to accurately reach high-net-worth customer groups; carry out referral rebate activities and pet owner health lectures. Case: A high-end pet antibody product from Germany attracted traffic to the private domain through cooperation with high-end pet clubs, achieving a private domain sales volume of 30 million yuan in 2024.

3. Cooperative Empowerment Value

ChinaEntryHub.com can provide category-specific public and private domain operation support: On the public domain side, assist in matching channels suitable for each category (e.g., prescription drugs connecting with pet hospitals, OTC drugs connecting with compliant e-commerce), interpret channel compliance requirements (e.g., sales qualifications for prescription drugs, advertising specifications); assist in conducting channel academic training to improve product clinical application recognition. On the private domain side, design professional content operation plans for high-end/niche products (disease popularization copy, clinical case analysis), assist in building WeChat Work communities and pet doctor academic exchange platforms; connect with high-end pet hospitals and pet health management institution resources to accurately attract traffic to the private domain; optimize the cold chain connection plan of "public domain distribution + private domain delivery" combined with category cold chain requirements; rely on market data to match enterprises with optimal public-private domain ratio strategies (e.g., suggesting "public domain academic exposure + private domain clinical transformation" for diagnostic reagents, and "public domain bulk distribution" for regular OTC drugs).

V. Core Compliance Risks and Cooperative Avoidance Strategies

From January to June 2025, China Customs and MARA investigated and handled 98 batches of substandard imported pet pharmaceuticals, including 42% biological products (core risks: inactivation of active ingredients due to cold chain disruption, failure to obtain imported veterinary drug registration certificates), 35% prescription drugs (core risks: non-compliant labels, excessive pharmacological ingredients, failure to complete clinical trials), and 23% diagnostic reagents (core risks: insufficient sensitivity/specificity, failure to obtain medical device registration certificates).

1. Category-Specific Risk Avoidance

- Biological products: ChinaEntryHub.com assists in designing whole-link cold chain plans, connecting with logistics enterprises qualified for veterinary cold chain, installing real-time temperature monitoring equipment, and ensuring temperature fluctuations are controlled within ±1℃; guides enterprises to conduct active ingredient testing before shipment to ensure product efficacy.

- Prescription drugs: Assists in completing the application for the "Imported Veterinary Drug Registration Certificate" in advance to ensure complete and compliant clinical trial data; reviews label compliance, focusing on verifying key information such as "prescription drug" logo, registration certificate number, dosage and administration, and contraindications; guides enterprises to conduct quality testing of each batch before import to avoid excessive ingredient risks.

- Diagnostic reagents: Assists in completing the application for the "Medical Device Registration Certificate" to ensure clinical verification data (sensitivity, specificity) meets national standards; guides enterprises to conduct product stability tests to ensure performance meets standards during the shelf life; avoids the risk of "over-range detection" claims.

- Cross-border e-commerce products: Assists in sorting out cross-border compliance requirements, clarifying restrictions on personal use and taboos on bulk sales; ensures labels are marked with "cross-border e-commerce exclusive" and "for personal use only" to avoid illegal sales risks.

VI. Summary and Outlook: Differentiated Cooperation to Empower Efficient Market Entry

China's pet pharmaceutical market is in a stage of standardized and high-end development. With the continuous upgrading of pet medical demand, the demand for high-end prescription drugs, biological products, and precise diagnostic reagents is growing rapidly, providing broad market opportunities for foreign enterprises. However, the differentiated compliance requirements of different categories of pet pharmaceuticals (e.g., rigorous clinical trials for prescription drugs, full cold chain for biological products, medical device registration for diagnostic reagents), complex approval processes, and strict channel control also bring many challenges to foreign enterprises entering China. The three paths of general trade, cross-border e-commerce, and joint venture/wholly-owned have their own applicable scenarios, requiring precise selection based on product characteristics and enterprise development strategies; the coordinated layout of public and private domain markets is the key to improving market penetration.

Based on in-depth interpretation of China's import regulatory policies for pet pharmaceuticals and rich practical experience, ChinaEntryHub.com China Market Access Service Center can provide "category-customized" full-link services: from early policy inquiry and compliance registration consultation, to mid-term transportation plan design and customs clearance assistance, and then to late-stage channel expansion and public-private domain operation support, comprehensively addressing the core pain points of foreign enterprises entering China. Cooperation can shorten the average preparation cycle for foreign enterprises to enter China by more than 50%, significantly reducing compliance risks and market expansion costs.

In the future, with the continuous improvement of China's pet pharmaceutical regulatory system, market access will become more standardized, and the focus of competition will be on product quality, clinical value, and brand services. Cooperating with ChinaEntryHub.com can not only help foreign enterprises achieve "rapid market entry" in China, but also rely on continuous policy update consultation and market adaptation adjustments to realize the transformation from "product entry" to "brand rooting", seizing an advantageous position in China's fiercely competitive pet pharmaceutical market.

Hiker

15+ years in investment & venture building & venture building;Executive Education in Management (Peking University);International Business major;Market entry architecture & key network access

Get a Direct Response from Our China Expertise.

he challenge you're facing is one we've already solved. Leverage our proven framework to receive your custom China blueprint.