First Steps to Enter the Chinese Market for Overseas SMEs

What are the biggest initial barriers for SMEs entering China?

- What are the biggest initial barriers for SMEs entering China?

- Market Research and Entry Strategy Formulation

- How to quickly validate your product demand in China?

- Navigating China's Unique Digital Ecosystem and Consumer Behavior

- Start with e-commerce or a local partner?

- Conclusion

- FAQ

- Ready to Take Your First Steps into the Chinese Market? Let China Entry Hub Guide You!

- References

China market research is the first step for foreign SMEs expanding into China. This critical initial step helps organizations navigate the complicated and changing Chinese market with a successful entrance plan. Any firm seeking to enter this massive market of nearly 1.4 billion users must understand consumer behavior, competition, and regulations. A detailed feasibility study is the first step in entering China. Make sure your product fits local demand, analyze rivals, evaluate pricing tactics, and learn about Chinese rules and regulations such industry access policies and product standards. Rapid entry is riskiest, but a systematic early evaluation may lay the basis for a successful China business. In-depth market research may help organizations understand customer preferences, find partners, and create Chinese-friendly strategies. This reduces risks and increases development and success in one of the world's biggest and most dynamic economies.

What are the biggest initial barriers for SMEs entering China?

SME entering the Chinese market requires careful preparation and strategic consideration of numerous major hurdles. A major obstacle is the complicated regulatory framework. China's legal system and commercial rules vary greatly from Western ones, needing substantial knowledge and local skills to negotiate.

Language and cultural barriers

Another challenge is the cultural and linguistic gap. Building connections and promoting goods requires understanding and adapting to Chinese business etiquette, communication methods, and customer preferences. Many SMEs overlook the need of localizing their products and marketing to Chinese preferences and customs.

Market Competition and Brand Recognition

The fierce Chinese market competitiveness is another issue. Foreign SMEs struggle because local companies have a strong presence and understand customer demands. Building brand awareness and trust among Chinese customers takes time and marketing and localization expenditure.

Complex Distribution and Logistics

Distributing efficiently and managing China's complicated logistics environment may be difficult for SMEs. Due to the country's size and infrastructural growth, a well-planned distribution strategy is needed.

Overcoming these constraints involves market research, careful planning, and frequently cooperation with local partners who understand the Chinese business ecosystem.SMEs may succeed in this attractive but challenging sector by tackling these issues.

Market Research and Entry Strategy Formulation

A solid China market entrance plan starts with thorough market research. Consumer behaviour, competition, regulation, and development prospects should be included in this Chinese market study.

Trends and preferences of consumers

Consumer trends and preferences are crucial to China market research. This involves researching buying behaviors, brand impressions, and industry-specific purchase considerations. Combining quantitative and qualitative research approaches may provide a more complete picture of the target market.

Competitive Analysis and Market Positioning

A detailed competition study is necessary to uncover market gaps and opportunities. This includes analyzing local and foreign rivals in China, their market share, price, and USPs. Chinese customers may be targeted with a distinct market positioning approach using such information.

Legal and regulatory issues

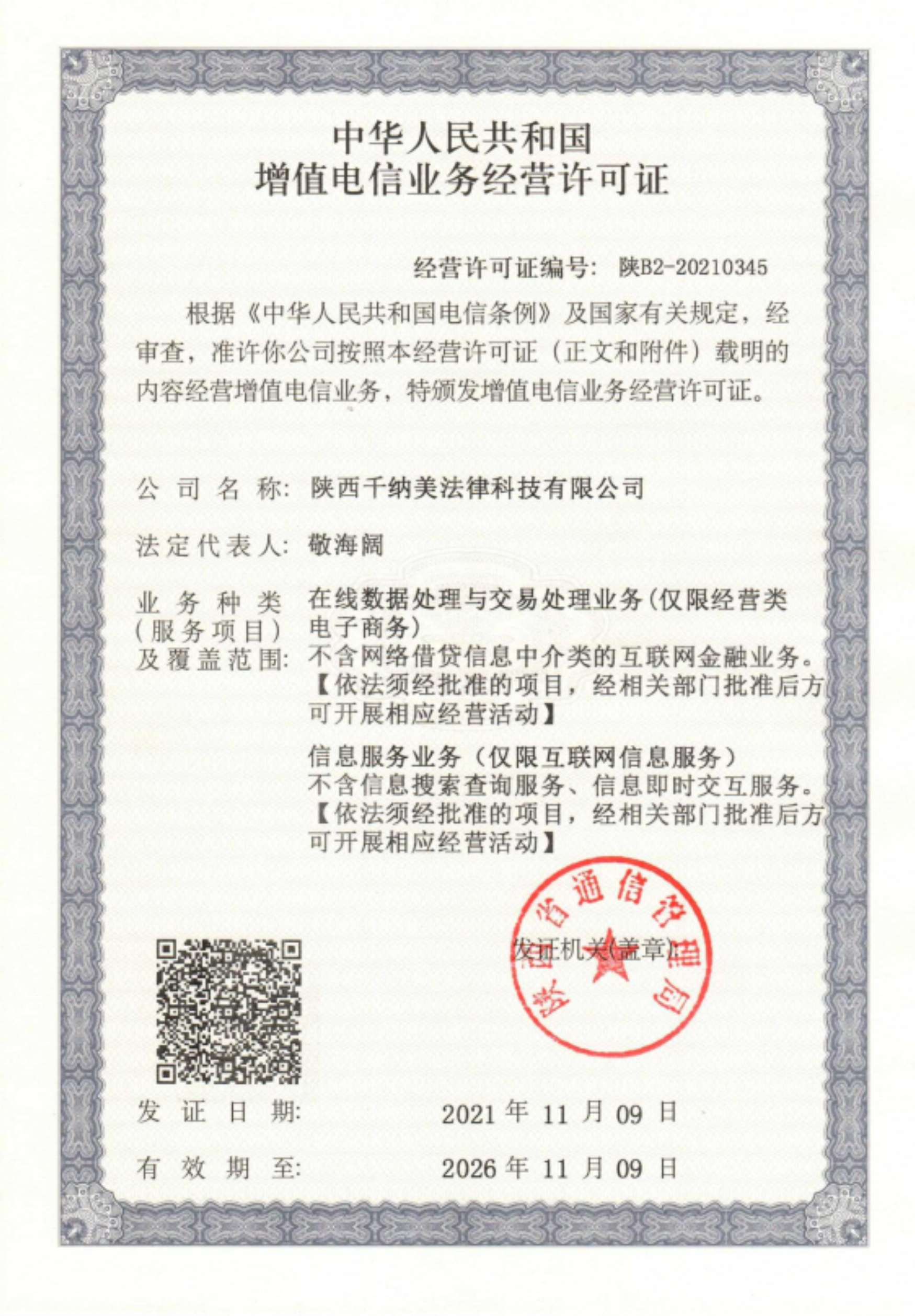

An successful entrance plan requires knowledge of China's regulations. This involves studying industry-specific rules, IP protection, and overseas company compliance. Local legal specialists can help navigate these complicated regulations.

SMEs may adjust their entrance approach to the Chinese market's particular difficulties and potential by combining these study results. This strategy should include Chinese business-specific goals, target markets, marketing strategies, and operational plans.

How to quickly validate your product demand in China?

SME entry into the enormous and competitive Chinese market requires product demand validation. Quick validation may save time and money and inform product localization and marketing plans.

Using E-commerce Platforms for Market Testing

Fast demand validation may be achieved using Chinese e-commerce platforms. These platforms make product testing and customer interest assessment low-risk. Companies may swiftly assess customer preferences, price sensitivity, and demand by selling items on Tmall Global or JD Worldwide.

Online polls and focus groups

Potential Chinese customers may submit direct input via online questionnaires and virtual focus groups. Companies may get qualitative insights about product appeal, price expectations, and Chinese market improvements using these strategies. Culturally suitable survey design and reliable findings are possible with local market research businesses.

Social media trend analysis and engagement monitoring

Weibo and WeChat can provide real-time customer trends and preferences. Analyzing conversations, hashtags, and activity regarding comparable items might reveal market potential and customer pain areas your product could solve.

SMEs may swiftly verify their product's potential in China using these approaches, enabling informed market entrance and product adaption choices.

Navigating China's Unique Digital Ecosystem and Consumer Behavior

Understanding China's digital landscape is crucial for any SME looking to establish a presence in the market. The Chinese digital ecosystem has different dominating actors and user behaviors than Western platforms.

WeChat: More Than Messaging

Chinese digital life revolves on WeChat, a'super app'. It integrates texting, social networking, e-commerce, and payments. Businesses may use WeChat for client interaction, brand promotion, and direct sales via mini-programs. China market research and entrance plans generally include WeChat strategy development.

Short-Form Video and Live Streaming Rise

TikTok's Chinese equivalent, Douyin, and Kuaishou have transformed Chinese content consumption and e-commerce. Live broadcasting is very effective for product demos and sales. Understanding how to use these channels helps boost a product's Chinese sales.

Mobile-First Consumerism

Chinese customers are mostly mobile-first, using smartphones for internet activities. This mobile-centricity affects product design and marketing. Successfully entering the Chinese market requires mobile compatibility and user experience optimization. These distinctive elements of China's digital ecosystem may help SMEs access and engage Chinese customers, improving their chances of success in this dynamic market.

Start with e-commerce or a local partner?

Starting with e-commerce or finding a local partner is a significant strategic choice for SMEs entering China. Both methods have pros and cons, and the optimal one relies on the product, industry, and corporate resources.

Pros and Cons of E-commerce

E-commerce is a low-risk way to enter China. Tmall Global provides infrastructure and a vast customer base. This method provides immediate customer input and product testing without major infrastructure expenditure. It involves expertise in Chinese e-commerce, digital marketing, and logistical management.

Local Distributor Partnership: Pros and Cons

Local expertise, contacts, and distribution methods might be beneficial from a local partner or distributor. This method works well for hands-on sales or highly regulated items. However, protecting intellectual property and aligning corporate objectives demands careful partner selection and unambiguous agreements.

Blended Strategies

Many successful SMEs combine e-commerce with smart local connections. This offers direct customer connection and local market experience. This selection should be based on market research, product qualities, and corporate goals. China market research, product-specific needs, and company strategy should determine whether to use e-commerce or local partnerships.

Conclusion

Foreign SMEs entering the Chinese market are risky but possibly lucrative. Complete China market research is the basis for all future initiatives and choices. This approach requires understanding Chinese consumer behavior, navigating the internet environment, and determining the correct entrance strategy. Whether using e-commerce or local relationships, success in China demands agility, cultural awareness, and a willingness to learn and adapt. The Chinese market's size and vitality provide potential but need careful strategy and execution. SMEs may succeed in one of the world's most fascinating and demanding marketplaces by concentrating on market research, product validation, and strategic decision-making. Entering China requires reinventing your company for a thriving market, not merely translating your tactics.

FAQ

Q: How long does complete China market research take?

A: China market research length varies by sector and breadth. Market research takes 3–6 months. This period provides for detailed consumer behavior, competitive landscape, and regulatory studies.

Q: What criteria should be considered while selecting e-commerce or local partnerships in China?

A: Product kind, audience, resources, and long-term objectives are important. For general consumer items, e-commerce may work, while local partnerships may be better for specialist or B2B products. Consider your company's China cross-border logistics and digital marketing capabilities.

Q: How crucial is Chinese product localization?

A: Success in China requires product localization. Chinese customers have different tastes and expectations than Westerners. Localization extends beyond translation and may entail changing product features, packaging, or fundamental functions to match local preferences and requirements. Effective localization may boost a product's Chinese market performance.

Ready to Take Your First Steps into the Chinese Market? Let China Entry Hub Guide You!

Embarking on your China market entry journey can be daunting, but you don't have to go it alone. At China Entry Hub, we specialize in guiding overseas SMEs through the complexities of the Chinese market. Our team of experts combines local insights with professional execution to ensure your entry strategy is tailored, compliant, and effective. With our 100% aligned interests - we only succeed when you do - and our end-to-end support, we simplify the complex process of entering China. From conducting in-depth China market research to connecting you with pre-screened service partners, we're your trusted interface in the Chinese market. Ready to explore the opportunities awaiting your business in China? Contact us today at info@chinaentryhub.com to start your China success story. Let China Entry Hub be your gateway to unlocking the potential of the world's largest consumer market!

References

1. Chen, L. (2022). "Navigating China's Digital Ecosystem: A Guide for Foreign Businesses." Journal of International Marketing, 30(2), 45-62.

2. Wang, H., & Li, X. (2021). "E-commerce vs. Traditional Distribution: Market Entry Strategies for SMEs in China." Asian Business & Management, 20(3), 301-320.

3. Zhang, Y. (2023). "Consumer Behavior Trends in China: Implications for Foreign Brands." International Journal of Emerging Markets, 18(1), 112-130.

4. Liu, J., & Smith, A. (2022). "Regulatory Challenges for Foreign SMEs in China: A Comparative Analysis." Journal of World Business, 57(4), 101272.

5. Brown, M., & Cheng, W. (2021). "The Role of WeChat in China's Digital Marketing Landscape." Digital Marketing Quarterly, 15(3), 78-95.

6. Thompson, R. (2023). "Product Localization Strategies for the Chinese Market: Case Studies of Successful Adaptations." Global Strategy Journal, 13(2), 245-263. 7. Lee, S., & Wu, Y. (2022). "Market Research Methodologies for China: Balancing Quantitative and Qualitative Approaches." International Business Review, 31(3), 101921.

Sonia

8+ years in financial engineering & legal advisory;Compliance & Execution Dept;Due diligence & partnership structuring;Operational Risk Controller

Get a Direct Response from Our China Expertise.

he challenge you're facing is one we've already solved. Leverage our proven framework to receive your custom China blueprint.